Investing in real estate can be highly profitable—if you know how to calculate property ROI before investing. Whether you’re buying a home, a rental property, or a commercial space, understanding your Return on Investment (ROI) is crucial to making smart financial decisions.

In this guide, we’ll break down:

✔ What is Property ROI & Why It Matters

✔ Different Methods to Calculate ROI

✔ Key Factors That Impact Your Returns

✔ Common Mistakes to Avoid

✔ Tools & Formulas for Accurate ROI Calculation

By the end, you’ll know exactly how to evaluate a property’s profitability before signing the deal.

Why Calculating Property ROI is a MUST Before Investing

What is ROI in Real Estate?

ROI (Return on Investment) measures how much profit you make from a property compared to its cost. It helps you:

✅ Compare different investment opportunities

✅ Forecast long-term profitability

✅ Avoid overpaying for underperforming assets

Why Does ROI Matter?

- Avoid Bad Investments: Some properties look great but offer poor returns.

- Maximize Profitability: Helps you pick assets with the best appreciation & rental income.

- Plan Finances Better: You’ll know if a property aligns with your financial goals.

Now, let’s dive into how to calculate it correctly.

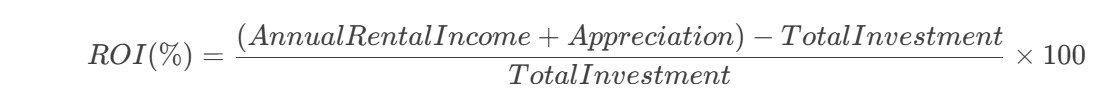

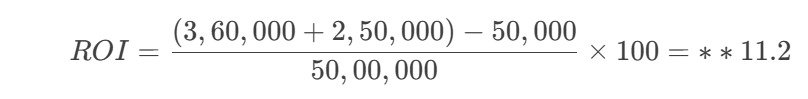

Method 1: Simple ROI Calculation (Basic Formula)

Formula:

Example:

- Property Price: ₹50,00,000

- Annual Rent: ₹3,60,000 (₹30,000/month)

- Annual Appreciation: 5% (₹2,50,000)

- Maintenance & Taxes: ₹50,000/year

Calculation:

Verdict: An 11.2% ROI is decent, but let’s explore more accurate methods.

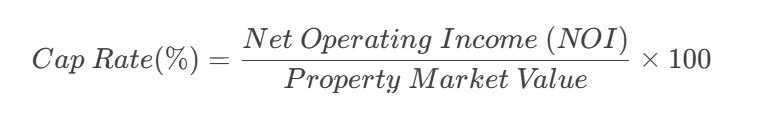

Method 2: Cap Rate (Best for Rental Properties)

What is Cap Rate?

The Capitalization Rate measures ROI without considering loans. Ideal for comparing rental properties.

Formula:

Example:

- Property Value: ₹50,00,000

- Annual Rent: ₹4,20,000

- Expenses (Maintenance, Tax, Vacancy): ₹1,20,000

- NOI: ₹4,20,000 – ₹1,20,000 = ₹3,00,000

Calculation:

Interpretation:

- <5%: Low ROI (May not cover costs)

- 5-8%: Moderate (Good for stable income)

- >8%: High (Best for investors)

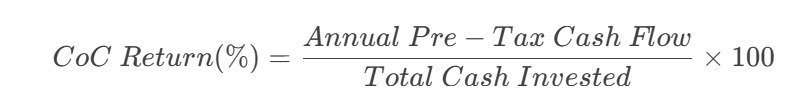

Method 3: Cash-on-Cash Return (For Leveraged Investments)

What is Cash-on-Cash Return?

Measures ROI after accounting for mortgage payments. Best for loan-financed properties.

Formula:

Example:

- Down Payment (20%): ₹10,00,000

- Loan EMI (Yearly): ₹3,60,000

- Annual Rent: ₹4,20,000

- Expenses: ₹1,20,000

- Pre-Tax Cash Flow: ₹4,20,000 – (₹3,60,000 + ₹1,20,000) = (-₹60,000)

Oops! Negative Cash Flow → Bad Investment.

Pro Tip: Always calculate CoC before taking a loan!

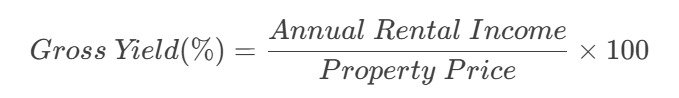

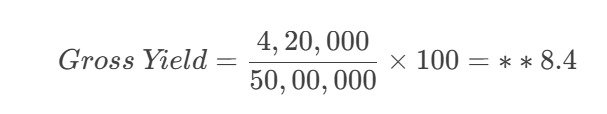

Method 4: Gross Yield (Quick Rental ROI Estimate)

What is Gross Yield?

A fast way to compare rental properties before deducting expenses.

Formula:

Example:

- Property Price: ₹50,00,000

- Annual Rent: ₹4,20,000

Calculation:

Note: Doesn’t include expenses—use Cap Rate for a more accurate picture.

Key Factors That Affect Property ROI

1. Location

- High Demand Areas (e.g., near metros, offices) = Higher Rent & Appreciation

- Upcoming Areas (e.g., Gota, Bopal) = Lower Entry Cost, Higher Future ROI

2. Property Type

- Residential: Stable but lower returns (~4-8%)

- Commercial: Higher ROI (~8-12%) but riskier

3. Financing Costs

- Higher loan interest = Lower Cash Flow

- Always compare EMI vs. Rental Income

4. Maintenance & Taxes

- Older properties = Higher upkeep costs

- Property tax, society charges impact net returns

5. Vacancy Rates

- High vacancy = Lower annual income

- Check local rental demand before investing

Common ROI Calculation Mistakes to Avoid

❌ Ignoring Hidden Costs (Registration, GST, Brokerage)

❌ Overestimating Rental Income (Always check market rates)

❌ Underestimating Maintenance (Older properties need more repairs)

❌ Not Factoring in Loan Interest (Kills cash flow if rent < EMI)

❌ Forgetting Appreciation Potential (Some areas grow faster)

Free Tools to Calculate Property ROI Easily

- MagicBricks ROI Calculator

- 99acres Investment Calculator

- BankBazaar EMI + ROI Planner

Pro Tip: Use Excel/Google Sheets for custom calculations.

Going Beyond Basic ROI Calculations

While the standard ROI formula gives you a surface-level understanding, seasoned investors analyze multiple financial layers to determine true profitability. One critical factor often overlooked is time-weighted returns – a property generating ₹5 lakh annually holds different value if that income comes steadily over 12 months versus lump-sum payments. This affects cash flow planning significantly.

Another dimension is opportunity cost comparison. If a ₹75 lakh property delivers 6% ROI but you could earn 8% in REITs with zero maintenance hassle, is the physical asset truly better? Savvy investors always benchmark against alternative investments.

The Impact of Leverage on ROI

Purchasing with a mortgage dramatically alters your ROI structure. A ₹1 crore property with 20% downpayment means you’re investing ₹20 lakh while controlling an asset five times larger. If the property appreciates 10% (₹10 lakh gain), your actual ROI isn’t 10% – it’s 50% on your invested capital (₹10 lakh gain ÷ ₹20 lakh investment). However, this works both ways – a 5% price drop wipes out 25% of your equity.

Hidden Costs That Slash Returns

Most investors account for obvious expenses like maintenance but miss:

- Tenant turnover costs (1-2 months’ rent for brokerages + repairs)

- Capital expenditures (Elevator replacements, facade repairs)

- Taxation changes (Potential revision in property tax slabs)

- Society fee hikes (Especially in aging buildings needing major repairs)

A Mumbai high-rise recently saw ROI drop from 5.8% to 4.3% after a ₹25 lakh special levy for structural repairs – a scenario due diligence should anticipate.

Location-Specific ROI Variables

ROI calculations must adapt to local realities:

- In Bengaluru’s tech corridors, shorter tenant cycles mean higher vacancy risks

- Delhi’s unauthorized colonies may show high yields but carry title risks

- Goa’s seasonal rentals deliver 8 months of income, not 12

A Navi Mumbai investor learned this when their projected 6% ROI fell to 4.2% because monsoon flooding made the basement parking unusable for 3 months annually, forcing rent discounts.

Future-Proofing Your ROI

Truly strategic investors model three scenarios before buying:

- Base Case – Current rental income with 5% annual rent hikes

- Stress Case – 20% vacancy periods + 3% higher maintenance

- Growth Case – Area infrastructure boosting rents 10% annually

A Hyderabad IT park apartment that seemed mediocre at 5% ROI became a 7.2% yielding asset after a new metro station announcement – investors who’d analyzed municipal development plans spotted this early.

The Psychology of ROI Perception

Human bias often distorts ROI analysis:

- Anchoring – Overvaluing a property because its ₹80 lakh price seems low compared to the ₹1.1 crore asking price down the road

- Confirmation bias – Ignoring rising crime stats because you’re emotionally attached to a neighborhood

- Round-number fixation – Assuming ₹50,000/month rent is achievable just because it’s a clean figure

One Gurugram investor rejected a solid 5.8% ROI property holding out for “at least 6%” – two years later, market rates had adjusted and the best available was 4.9%.

When High ROI Signals Danger

Counterintuitively, exceptionally high advertised ROI (8%+) often indicates:

- Rent control properties where tenants can’t be evicted

- Disputed titles that may lead to legal costs

- Upcoming regulatory changes (Like Delhi’s sealing drive)

A Chennai investor attracted by 9% yields later discovered the building lacked OC (Occupancy Certificate), making rentals technically illegal and unenforceable in court.

Final Verdict: What’s a Good ROI in Real Estate?

| ROI Range | Verdict |

| <5% | Poor (Better to invest in FD/Mutual Funds) |

| 5-8% | Decent (Stable for long-term investors) |

| 8-12% | Great (Ideal for high returns) |

| >12% | Exceptional (Rare, usually in high-risk areas) |

Ready to Invest? Let AroundTown Realty Help!

Calculating ROI is complex—but we simplify it for you! At AroundTown Realty, we:

✔ Analyze ROI for every property before recommending

✔ Compare multiple investment options for maximum returns

✔ Provide legal & financial guidance for risk-free investing

📞 Contact us today to find high-ROI properties in Ahmedabad!

Conclusion

Understanding Return on Investment (ROI) is crucial before investing in any property. By evaluating factors like rental yield, appreciation rate, property costs, and maintenance expenses, investors can determine the profitability of their investment.

In Ahmedabad, areas with high rental demand, upcoming infrastructure projects, and business hubs typically yield better ROI. Calculating net ROI after deducting all ownership costs ensures you make a well-informed decision.

For a detailed property ROI analysis and insights on the best real estate investments in Ahmedabad, check out Around Town Realty. Our real estate experts provide ROI calculators, investment strategies, and location-based insights to help you maximize your returns!

Don’t Guess—Calculate! Avoid bad investments by knowing your ROI first. Book a free consultation with AroundTown Realty today!

FAQs: Property ROI Calculation

1. What is a good ROI for rental property?

6-10% is ideal. Below 5% may not justify the risk.

2. How do you calculate ROI for a property bought with a loan?

Use Cash-on-Cash Return (includes EMI, down payment, and expenses).

3. Does property appreciation affect ROI?

Yes! Include expected appreciation for long-term ROI calculations.

4. Which is better: Cap Rate or Gross Yield?

Cap Rate (includes expenses) is more accurate than Gross Yield.

5. Can ROI be negative?

Yes, if rental income < EMI + expenses. Always check cash flow first!